01 Jan 1970 CA T.V.Muthu Abirami B.A.B.L.(Hons.),M.L.,A.C.A. Advocate

Any income received by an assessee in the previous year, for which the source is known and accounted, is subject to income tax under the particular head under which that source of income falls. Issues arises when the source of income is unknown or hidden from the revenue. In order to charge income tax on such unaccounted income, the parliament introduced Section 115BBE in the Income Tax Act, 1961 through the Finance Act of 2012.

05 Mar 2018 D. Anand Secretary RBA

Revenue Bar Association remembers its Doyen Late Shri. K.R. Ramamani on the eve of 20th Anniversary

22 Sep 2017 Senthil Kumar M.P.

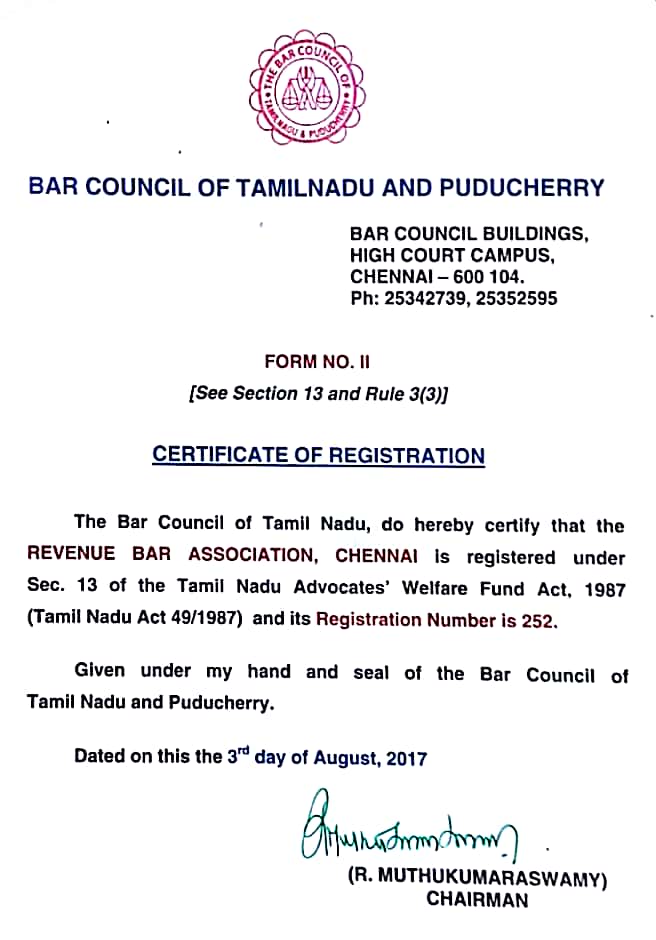

The Bar Council of Tamil Nadu has certified that the Revenue Bar Association, Chennai is registered under Sec.13 of the Tamil Nadu Advocate Welfare Fund, Act 1987.